How to do bank entry in ERP software

- Jun 6, 2018

- 3 min read

Updated: Jun 7, 2018

In this topic we will discuss how to do bank entry in ERP software. We will guide you to maintain the bank transactions in ERP software.

LET US START

First of all create your organization bank account. Click on account in master menu.

Click on new.

Suppose our organization bank current account is in ICIC bank. Thus fill ICIC bank in account name. Now select bank accounts in group block. Fill the current balance in bank account in opening balance. Now click on save.

Suppose we have O/D (limit) account in same bank then fill ICIC bank limit O/D account. Now select O/d account in group block. The main difference between o/d and current account is that current account is related to asset and O/d account is related to liability. Now fill the O/d limit in opening balance. Thus after filling all details click on save.Thus you can create all accounts of your organization in master.

Now we will discuss about bank entry.

In case of online RTGS, on receiving and giving cheque all these entries we will do in bank entry.

Click on bank entry in entries menu.

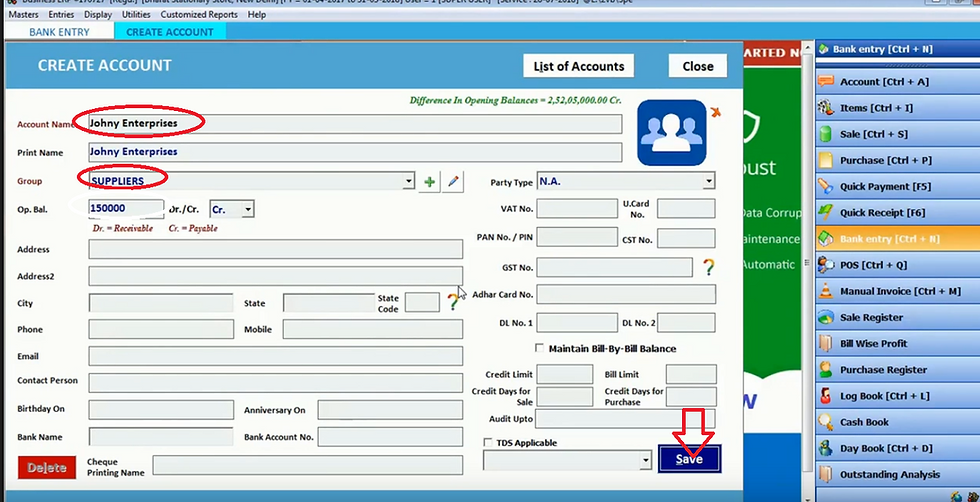

The software will automatically select current date. Now select bank entry. In case we issue a cheque to someone then select cheque issued in entry block. Now press F3 to create account of supplier.

Now fill name of supplier in account name. Select supplier in group block. Now suppose you have to pay 150,000 rupees to that supplier then fill that mount in opening balance block. We have to pay then we select credit. After filling all details click on save.

Now select this party and fill the amount of check we give to this supplier in amount block. Fill cheque number, cheque date and remarks and click on save. In case if you repeat cheque number then software will show you the warning.

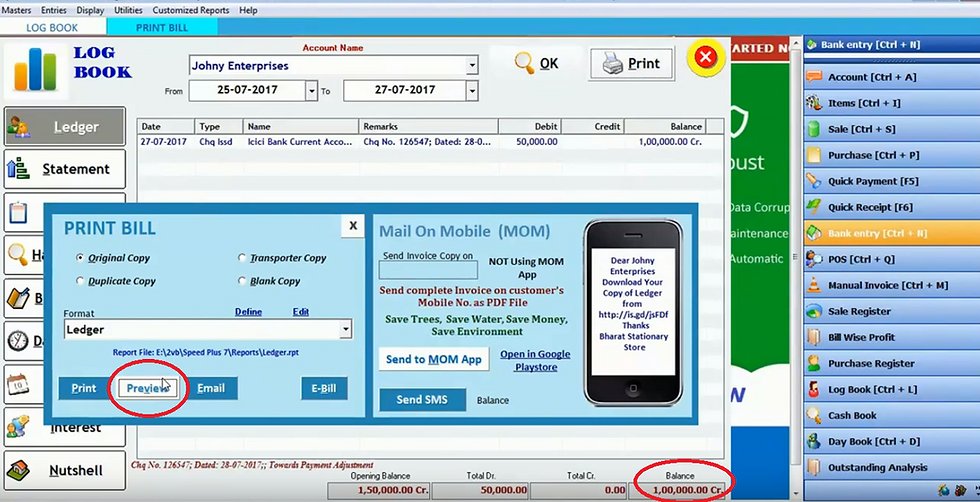

We are going to discuss you in detail. Click on log book in display menu.

Now select account name and date range then click OK.

Thus software will display the cheque detail. Now we will print this narration by clicking on print.

Then click on preview.

Thus software will show you print preview. Now close it.

Now we will check bank account report by selecting bank account in account name. Then click OK.

Thus software will display the report.

Now we will check cash book/ bank book by clicking on it in display menu.

Now select bank in account name and click OK.

Thus software will display how much we pay through cheque and how much balance is in bank account. Now close it.

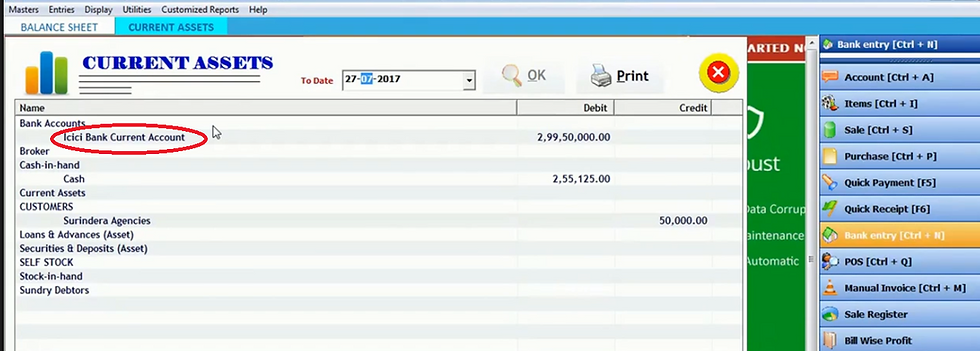

Now click on balance sheet in display menu.

Select date and click OK.

Now we will double click on current asset to see detailed assets.

Double click on ICIC bank.

Now click on Johny enterprises. Thus it will display entry.

Now we will click on bank entry in entries menu.

Select bank and select draft issued in entry block as we drafted. Now select party and draft amount. How much expenses on draft we will fill in expenses block. Now fill cheque number, date and remarks. Then click save.

If you receive the amount through bank it can by cheque, draft etc. Then select Cheque/draft/ RTGS received. Now we will press F3 in party block.

Now fill party in account name. Select customer in group block. Suppose we have to receive 5,00000 rupees from this customer then fill this amount in opening balance and select debit and click on save.

Now select this customer and fill the amount we receive from this customer. Fill cheque number, date of cheque and remarks then click on save.

In case we pay online the select online transfer in entry. Suppose we transfer through O/d bank then select O/d bank in Bank block. Now fill amount we transfer online and expenses on that transfer. Now click on save.

Let us see how to do withdraw and deposit cash entry in this software. Firstly select the bank from which we withdraw the cash. In party block cash will be automatically selected. Fill the amount of withdraw cash. Fill cheque number, date and remarks then click on save.

If we deposit cash in bank then select deposit cash in bank in entry block. Fill amount of deposited cash. Now click on save.

Thus all bank entries will maintain here.

If the bank charges from you then you need not to do separate entry of it. Select bank expenses in entry. Select bank charges in party. Fill the amount of charges in amount block. Now click on save.

Now we will check our bank status. Thus click on cash/bank book in display menu.

Select bank and click OK.

Thus software will display all bank transaction entries.

Now we will check bank reconciliation statement by selecting it in account books in display menu.

Now select bank in account name block and click OK.

Thus you can check clear and unclear entries by tick it.

Comments