Management of I-J form entries for commision agent

- May 18, 2018

- 5 min read

Updated: May 19, 2018

In this topic we will discuss how to manage I form and J form entries in ERP software

Business of commission agent is different from other business. In this business sale and purchase does not include.

A farmer sales his grains to the commission agent and that agent sale this crop on auction

to a businessman or government agency.

After deducing labour payment the crop price is given to the farmer.

The agent demand the commission and extra expenses from the customer who purchase crop.

A commission agent issue a J form to the farmer.

When a commission agent loaded the grains to a purchase

then he issue a I form to the purchaser. I-form also known as auction sale.

Let us see how to computerized grain market procedure in ERP software.

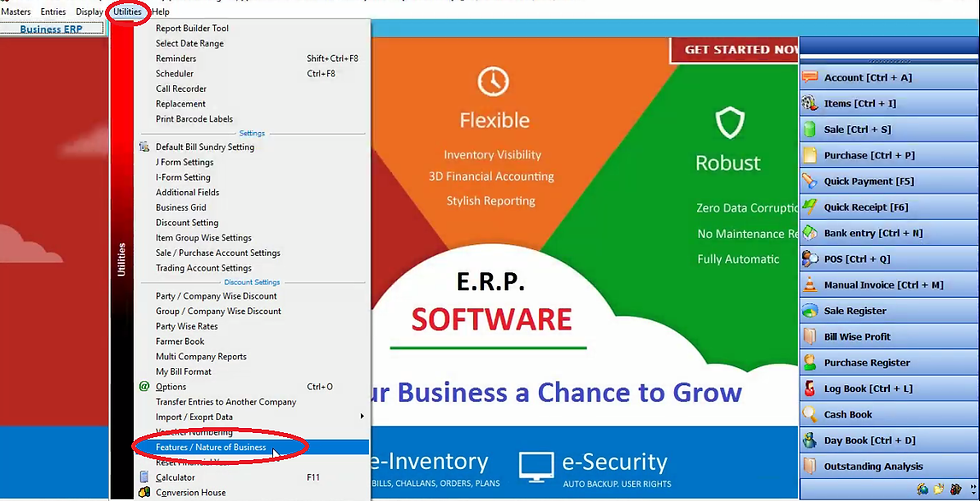

First of all we are doing setting by clicking on feature/nature of business in utilities menu.

Tick commission agent/ I form,J form and click on update. All reports of grain market will be activated after clicking on update.

In some states j-form and i-form known as vikraya parchi and auction sale respectively.

If you want to set j-form and i-form as vikraya parchi and auction sale then click on options in utilities menu.

Click on printing.

Here tick vikray parchi and auction sale and click on apply. For now select J form and I form. Now close it.

Now we will create account of all customers and suppliers.

Click on account on right hand side.

Click on new.

Fill customer name in account name and select customer in group as we are creating customer account. After filling all details click on save. Now close it.

We will create grains as item.

Click on items on right hand side.

Click new.

Let us create wheat as an item. Select tax slab, company and group. Now fill quantal per nag starting with 0. For eg. We take 0.35 kg it means 35 kg of wheat is in one nag. In primary unit we will select quantal as the price applied on quantal. Fill the sale price of one quantal and click on save. Thus as you get crops from the farmer you can add it as a item in ERP software.

Now we do entry of all expense.

For that click on bill sundry in master menu.

Click on new to create expenses account.

Now we will take majdoori as charge heading as we will charge from the farmer for majdoori Select labour in account head. Expenses of majdoori is subtracted from farmer payment. Thus we will tick on minus. Now select majdoori on bag. Then click on save. Now close it.

Now we will set the expanses applied in I form and J form.

Thus click on J form setting in utilities menu.

Click on new.

Now select mandi. You can also create new mandi by pressing function key F3.

After filling detail of mandi click on save. Now close it.

Thus this mandi will be added in list of mandi name. After selecting mandi name select item/crop of which you want to set J form. Now we will select majdoori because we want to apply this expense in J form. How much we deduct the expenses of majdoori per nag from farmer payment we will fill in calcularte @. Click on add item.

Click on save. Thus in this way we can do J form setting. Now close it.

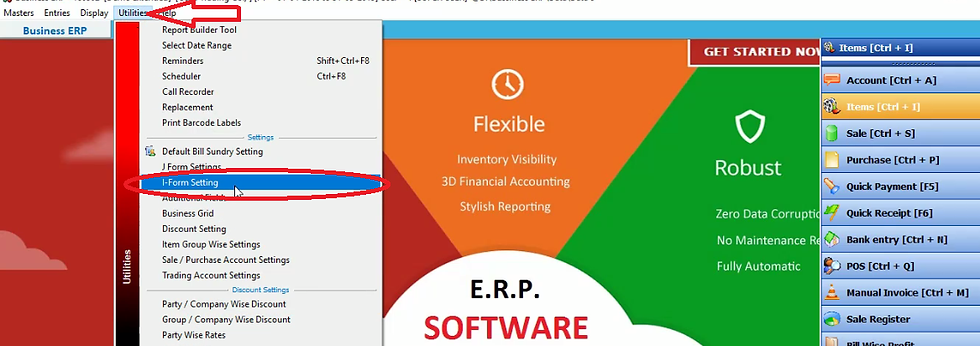

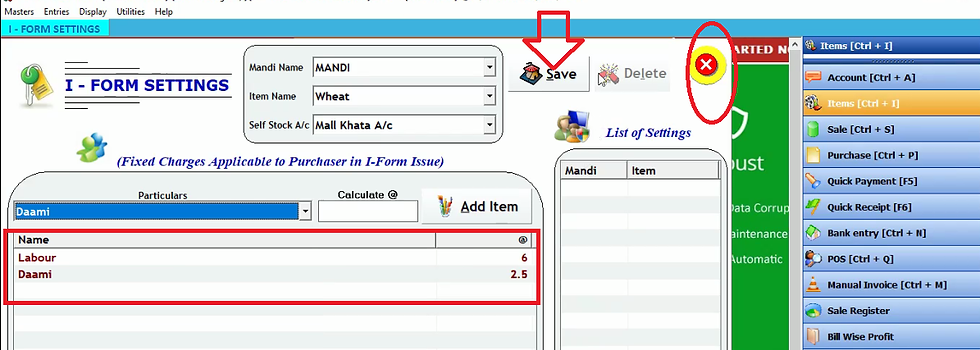

Now we will set expenses in I form.

Click on I form setting in utilities menu.

Click on new.

Select mandi name, item name and self stock account. Now we will select expenses implied in I form. For eg. We will select labour in particulars and fill the price of labour per nug in calculate@. Then click on add item.

Now we will select daami(commission) in particulars. Fill calculate@ and click on add item.

Click on save. Now close it.

After doing master entry we will do I form and J form entry.

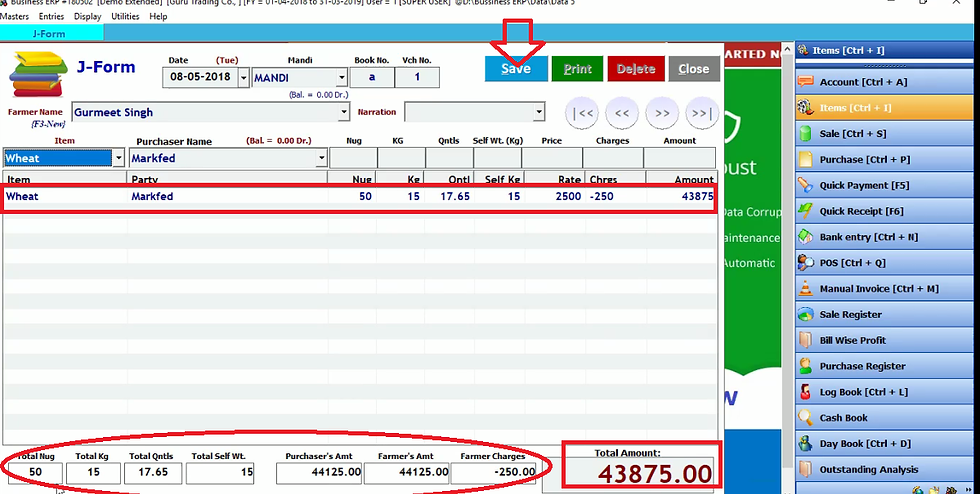

To do J form entry click on J form in entries menu.

Click on new.

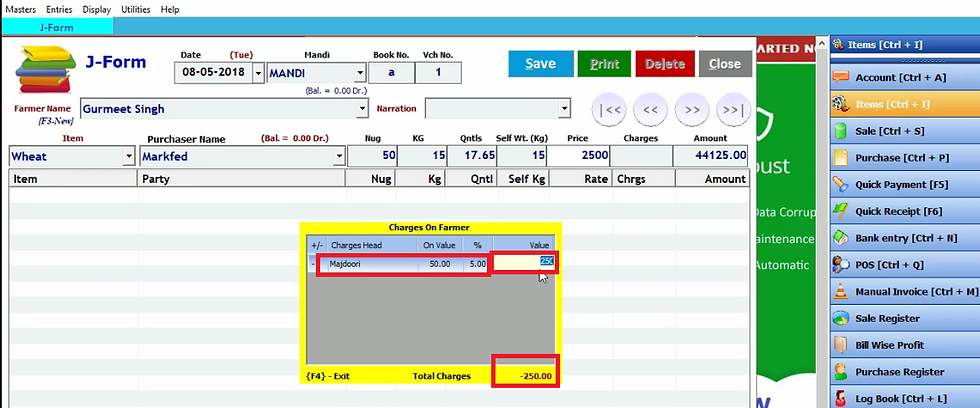

Fill date of J form entry. Fill manual book number and voucher number. Voucher number means J form series. Now select farmer name to whom we will issue J form. Select item we get from farmer and fill the purchaser name who purchase that item. Fill the total nag of items from farmer. If above the nag there is loose stock then we will fill in kg block. Now software will automatically calculate it in terms of quantal. If you want to manage loose stock separately then fill this loose stock value in self weight. Thus software will calculate the price of per quantal stock. Now press enter.

Thus a new tab will display the expenses applied in J form. Here we have select 50 nug and the cost of majdoori per nag is 5 rupees then software will calculate total majdoori expenses on 50 nug.

After entering this value in charges this value will be deduct from total payment of farmer. Thus software will calculate the payment of farmer. Now press enter.Thus below it will display the total nug, farmer charges, total amount etc. Now click on save. Close it by clicking on close. If you want to view print preview click yes otherwise click NO.

Now we will do I form entry. Click on I form in entries menu.

Click on new.

Select date and mandi. Fill book number, I form number and select purchaser name. Now press enter. As we press enter the software will display the farmer name of whom this purchaser agency will buy the stock. Basically it display the J form entry we have done previously. Click on save. Now close it.

Now we will check effect of these entries on reports.

Click yes if you want to view preview otherwise click no.

Now we will check effect of these entries on reports.

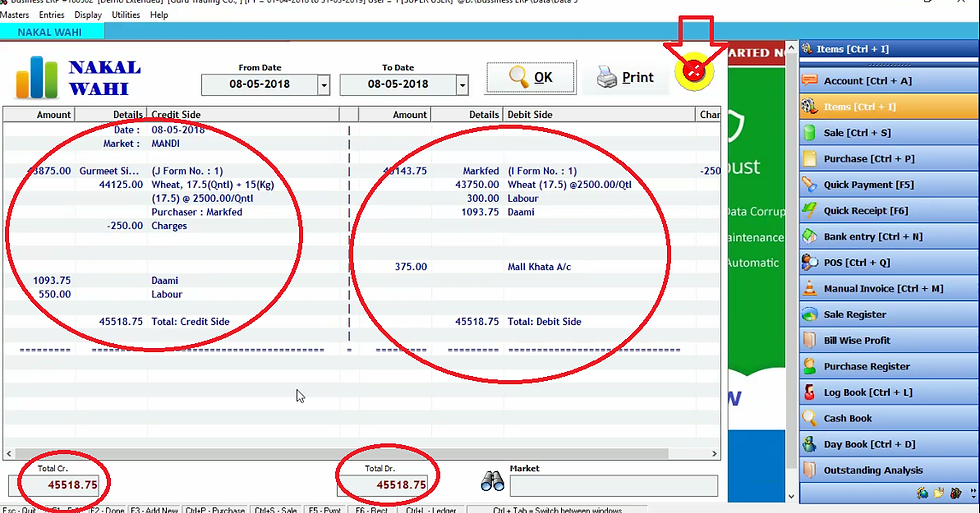

First of all click on nakal wahi in commodity reports in display menu.

Now select date range and click OK.

Thus it will display J form detail on left hand side and I form detail on right hand side. Now close it.

Now we will check J form register by clicking on J form register in commodity reports in display menu.

Now select date range and click OK.

This will display J form detail. Thus as soon as you will do J form entry it’s J form report will be prepared here. Now close it.

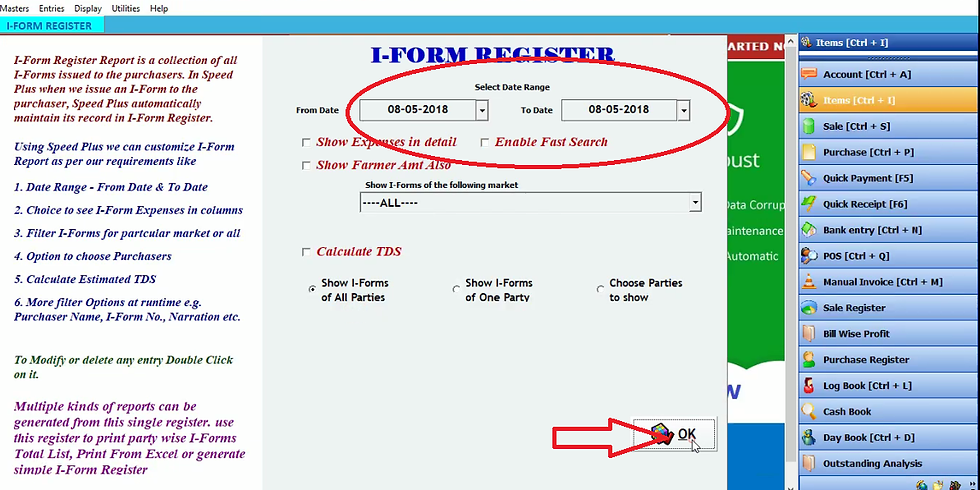

In the same way you can check I form report by clicking on I form register in commodity reports in display menu.

Select date range and click OK.

It will display who was the purchase and on which date he purchased. Now close it.

You can also check loose quantity of stock by clicking on mall khata summary in commodity reports in display menu.

After selecting date range click OK.

Thus it will display the loose stock as we entered this loose quantity before. Thus as you will do loose quantity entry, it’s report will be prepared in mall khata summary. Now close it.

You can also check mall khata of different item by clicking on mall khata item wise in commodity reports in display menu. You can also check mall khata register.

Now we will check financial accounting report by clicking on day book in display menu.

Select date range and click OK.

Thus it display all details. Now close it.

Now we will click on trading account in display menu.

Select date and click OK.

Commision agent get crops from farmers and sell it to the purchaser and receive his commission from purchaser. Thus this process does not affect sale and purchase entry. Therefore it is showing null opening and closing stock. Now close it.

Comments