Steps to E-File GSTR-1 using offline utility

- Jun 5, 2018

- 2 min read

In this topic we will discuss how to download offline utility of E-file GSTR-1 and how to convert billing information into JSON file using this offline utility.

We will discuss how to upload this file in government GST portal.

Let us start

First of all click on downloads in GST website. Now click on return offline tool.

As soon as you click on return offline tool, new page will display. Now click on download.

After downloading it unzip this file. As soon as you install it then the utility will be added in browser. Now fill GSTIN number, financial year and all details. Then click on proceed.

Now click on import files.

Now you can import data section wise. In case any mistake happen in any section data then it will be easy to find out. For this time we will import section wise. Now select B2B in section block. Then click on import CSV.

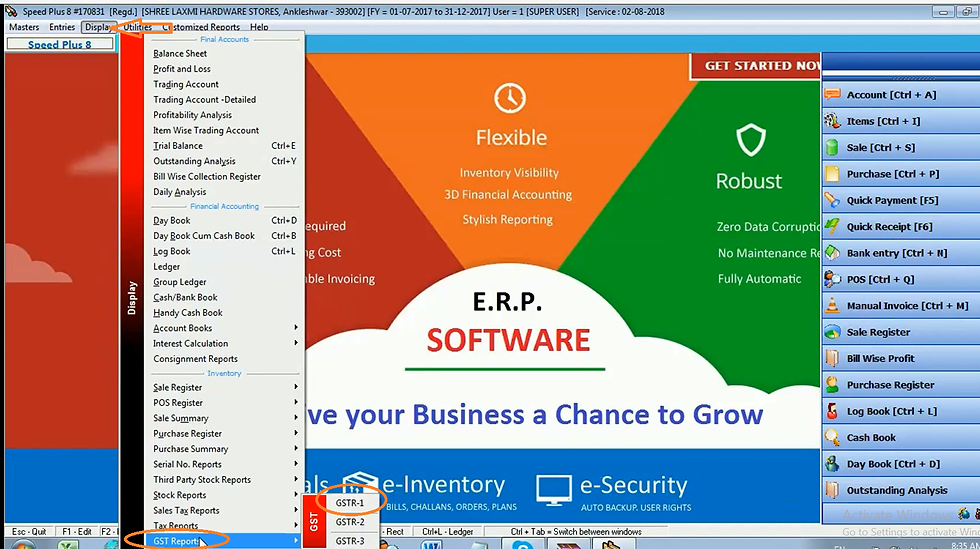

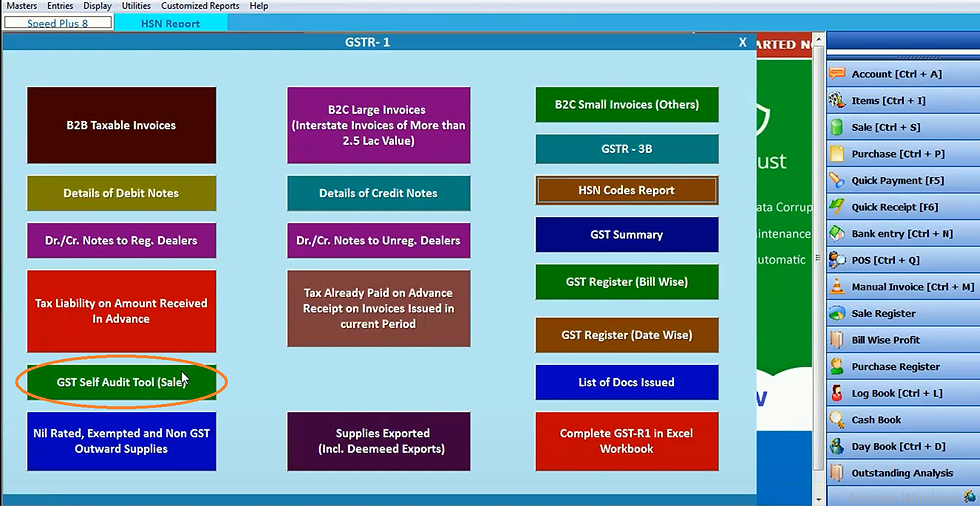

Click on GSTR-1 in GST report in display menu.

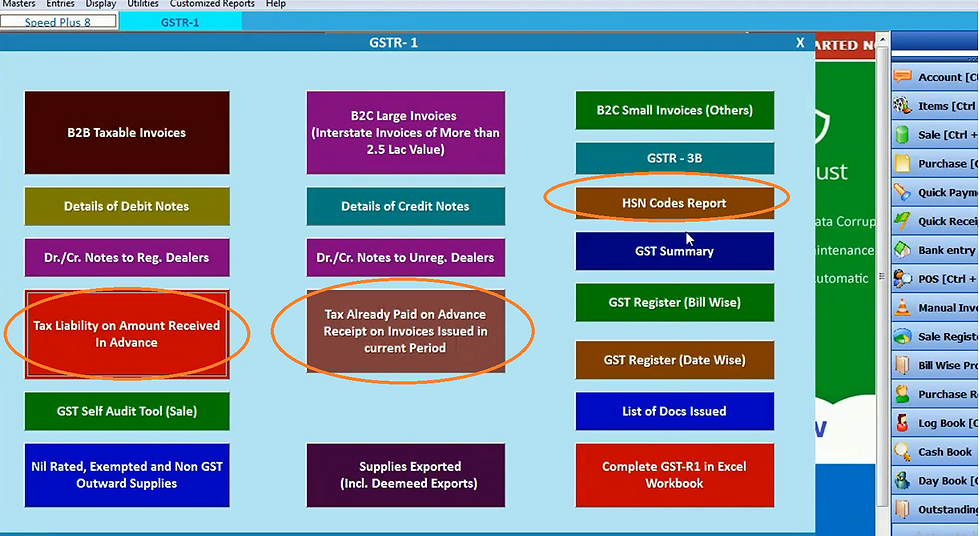

Click on B2B taxable invoices.

Select date range and click OK.

Thus it display the GST report. Now click on CSV format.

As soon as you click on CSV format, software will generate this report in CSV format.

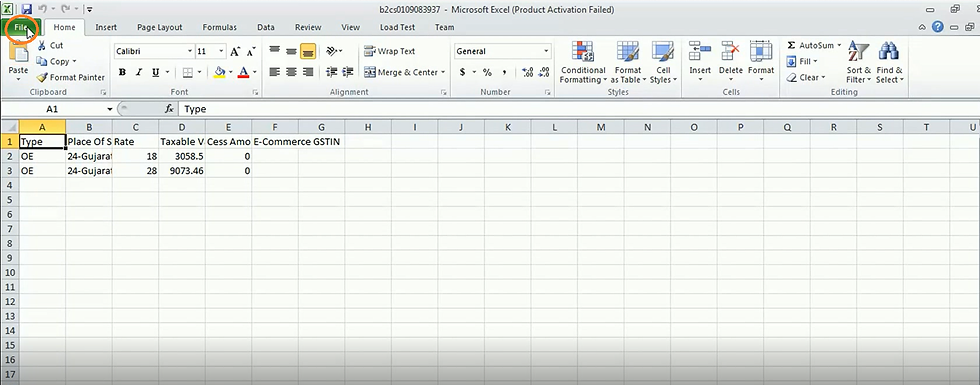

Now save as this file in excel.

For example we will create new folder and will save all CSV format in this folder. Now close it.

We will open our offline utility and we will share our path.

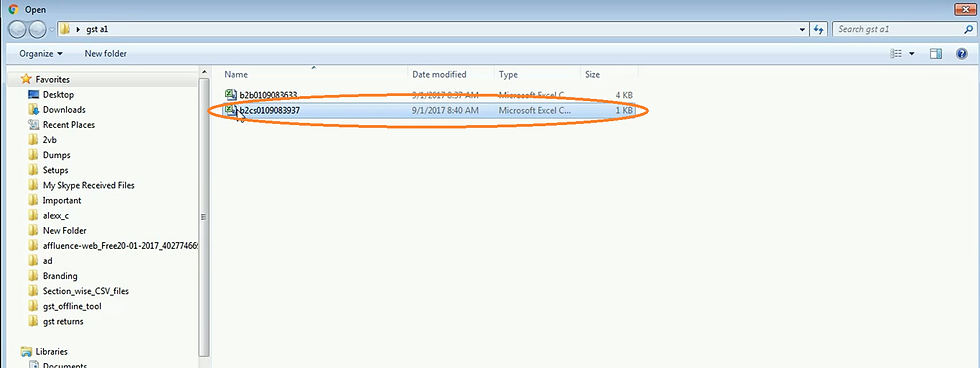

Now select the folder file which we have saved before.

As soon as you double click on excel file, software will show warning message. Now click on yes.

As we click on yes our data will be automatically uploaded. If you want to check it then click on view summary.

Then you can check file one by one.

Now click on import files.

Now select B2C small in section block.

Now in ERP software click on B2C small invoices.

Select date range and click OK.

Click on CSV format.

Now save this file in excel.

Now save this file in excel file.

Now click on import CSV in browser.

Thus save this file.

Now click yes to save this data.

Now to check this data click on view summary.

Then click B2C small to see data detail.

Thus in this way your return/GSTN format will ready.

You can also check advance receipt and the advance against which invoice is generated.

Now you can check HSN report by clicking on HSN report.

Select date and click OK.

Then click on CSV format.

Thus this file will save in excel.

Now click on import CSV. Then click on view summary.

Then click on HSN.

Then click yes.

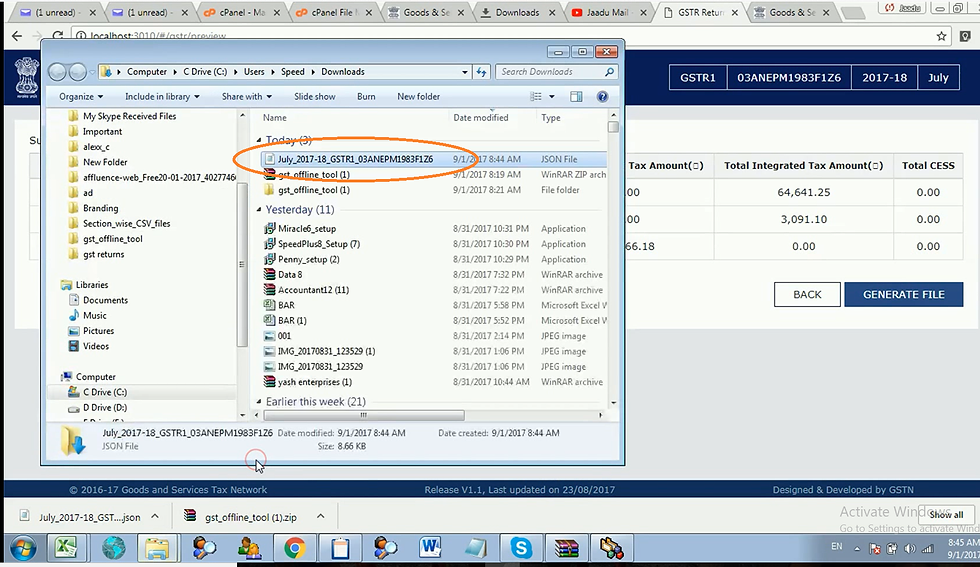

Thus this file will be uploaded. Thus these all GST billing will upload here. Thus after uploading these file click on generate file.

Thus JSON file will generate. You can upload this JSON file in government portal. You can send this file from government portal to your CA.

Now click on GST self audit tool.

Select date range and click OK.

In case any mistake happened (state code, IGST etc) then the software will show it by highlighting it.

Comments