B2C Sale Entry

- Mar 31, 2018

- 6 min read

Updated: Apr 14, 2018

In this topic we will discuss how to do B2C entry in Business ERP software. B2C sales means business to consumer sale. All sales with consumer and end user is called B2C sale. It is also known as retail sale. There is one difference between B2B and B2C sale that the customer can not claim input tax credit because he has not GST no. while in B2B sale customer can claim input tax credit.

In GST system B2C sale is divided into two parts

· B2C large

· B2C small

All sales that are done in out of state with more than 2,50,000 bill value is called B2C large and all sales s that are done in out of state or local state sale with less than 2,50,000 bill value is called B2C small. In case of local sale both above and below than 2,50,000, in both case it is B2C small. Now we are going to tell You how to do B2C sale account entry and how to manage GST report.

First of all let us create account of two customers one customer will be local and second will be out of state customer.

First of all click on account in master menu. You can also click on account directly on right hand side.

To create new account click on New. Firstly we will make within state consumer(customer) account .

Now fill the name of customer in In account name block and press enter. Now in group select customer as you are creating customer account and fill his address . As you fill the city of customer, in party type within state consumer will automatically select (because your company also in Delhi and his state is also Delhi, therefore it automatically select within state consumer). After filling all details click on save.

In this way you will create another customer account who is out of state customer and in the city block write that customer state. Here it is Punjab state and we do not fill GST no as the customer has not GST no. Then in Party type, software will automatically select out of state consumer. After filling all details of that customer click on save. Then close it by clicking on close.

Now we will do sale entry of these customers.

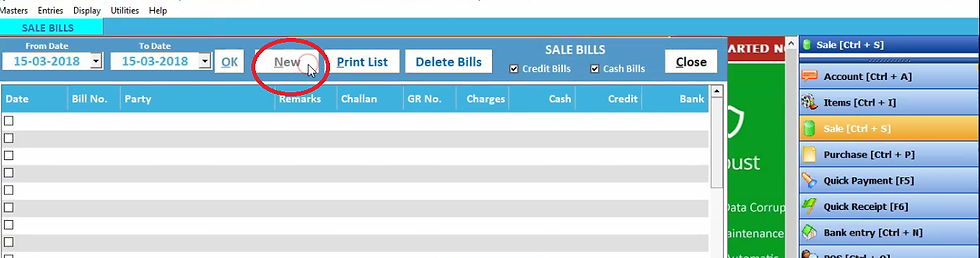

To do this click on sale given on Right hand side.

You can click on new to do new sale entry.

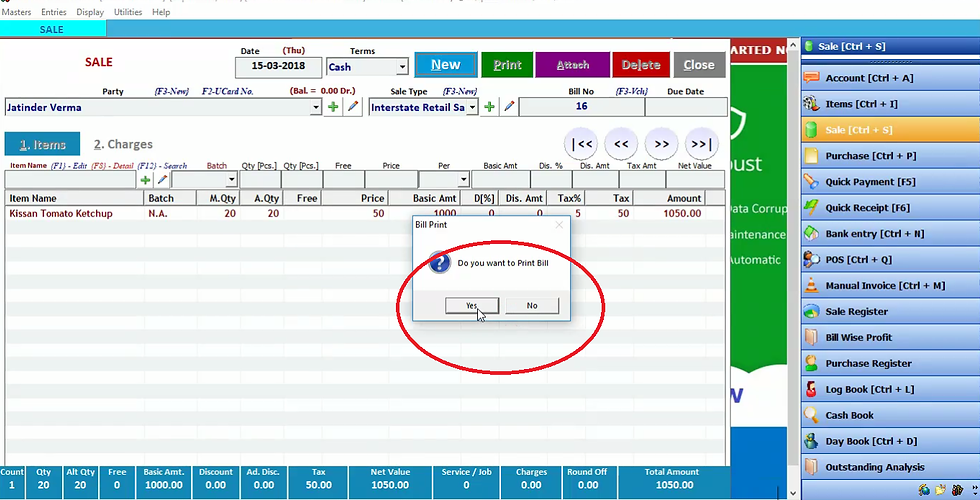

In date, current date will be selected automatically and press enter. Now in Terms if you are lending stock to customer then in terms select credit term. If Party buy the stock in cash then we will fill cash in terms.

Now fill party name and you will see the sale type will be automatically selected as local retail sale as you had created that customer account . fill bill number , due date, item name, item quantity which you are selling, price of item, discount offered to customer and tax. The net value of that item will be display accordingly. The net sale amount can be less than or more than 2,50,000 rs in case of local consumer and it is always considered as B2C small sale and click enter to add this item in item list.

and below you can see all details of the items you sell to that particular customer. Now click on save.

And press ok. you can enter multiple no. of items.

To see bill print, click on yes

Click on preview to see print preview. You can also send email and SMS on his mobile number.

In this print preview you can see that your GST no. is shown above but customer GST is not available. Now we will one more sale entry of out of state consumer.

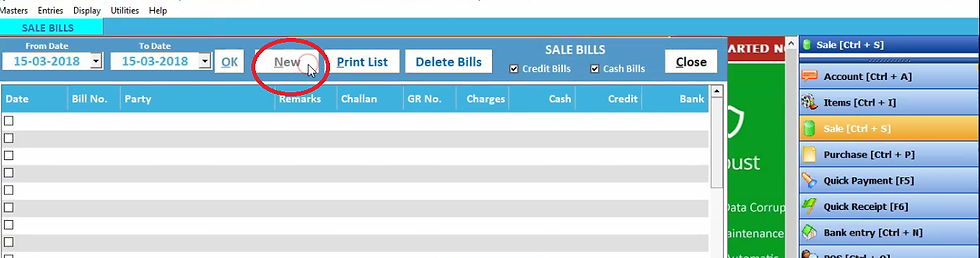

To do new sale entry click on new.

Now fill customer name as he is out of state consumer and you will see the sale type will be automatically selected as you have created that customer account . fill bill number , due date, item name, item quantity which you are selling, price of item, discount offered to customer and tax. The net value of that item display accordingly and click enter to add this item in item list.

and below you can see all details of the items you sell to that particular customer. Now click on save.

And press ok. you can enter multiple no. of items.

To see bill print, click on yes.

Click on preview to see print preview. You can print by clicking print.adjacent to preview. You can also send email and SMS on his mobile number. Now

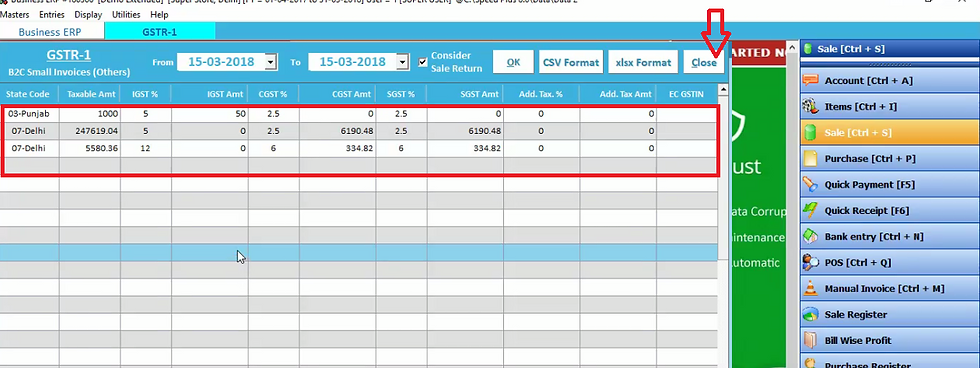

Let us check it’s effect in GST report. Click on display and select GST reports and to see sale entry wee will click on GSTR-1.

As we have done sale entry in case of both local and out of state consumer less than 2,50,000 therefore we will check GST report of them in B2C small invoices. If the sale amount is more than 2,50,000 Rs in case of out of state customer(consumer) then we will check his GST report in B2C large invoices. If sale value is less than 2,50,000 in case of out of state consumer then his GST report will be checked in B2C small invoices. II If sale amount is less or more than 2,50,000 in case of local consumer then we check his report in B2c small invoices.

Here you can select date to which you want to check GST report and click on OK.

You can see here both local and out of state sale entry which we had done. Now you can see all details of sale entry total tax, CGST, IGST etc then close it by clicking on close.

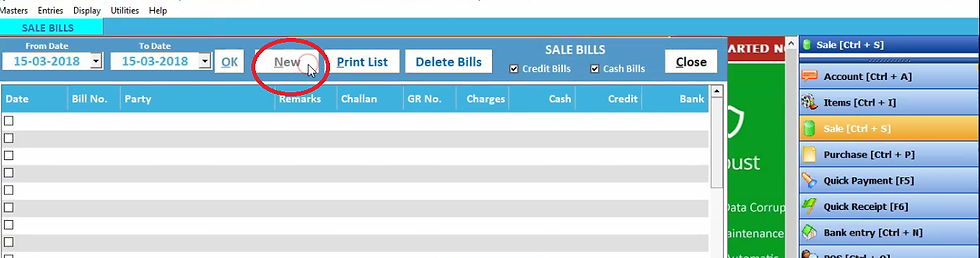

Now we will do sale entry for sale amount above than 2,50,000 Rs. Click on sale.

Click on new.

Now fill party name and you will see the sale type as local retail sale will be automatically selected as you have created that customer account . fill bill number , due date, item name, item quantity which you are selling, price of item, discount offered to customer and tax. The net value( that is more than 2,50,000 Rs) of that item will be display accordingly and click enter to add this item in item list.

Now this item will be added in sale . Now click on save.

Click ok.

Now click on yes to see bill print.

Click on preview to see print preview. You can print by clicking print.adjacent to preview. You can also send email and SMS on his mobile number. Now ths sT This sale entry was done for local customer sale amount above than 2,50,000 Rs. Now close it.

Now we will do sale entry for out of state costomer for sale amount bove than 2,50,000 Rs. Click on sale.

Click on new.

Now fill party name and you will see the sale type as interstate retail sale will be automatically selected as you have created that customer account . fill bill number , due date, item name, item quantity which you are selling, price of item, discount offered to customer and tax. The net value( that is more than 2,50,000 Rs) of that item will be display accordingly and click enter to add this item in item list. Click on save.

Click on OK.

Click yes to view bill print otherwise click on No. To view it’s effect in GST report Let us check it’s effect in GST report.

Click on display and select GST reports and to see sale entry wee will click on GSTR-1.

As we have done sale entry above than 2,50,000 Rs in case of both local and out of state customer .Thus we will check firstly B2C small invoices.

Click OK.

Now you will see the local customer sale entry below and above than 2,50,000 RS here. But out of state customer sale entry will not be available here. Because in Case of sale entry above than 2,50,000 Rs for out of state customer , affect can be seen in B2C large invoices. Now close it.

Click on B2C large invoices.

Click OK.

You will see here the sale entry above than 2,50,000 Rs for out of state customer. Now close it.

Thus in this way you can do B2C sale entry.

Comments