How to do bank charges entry in GST ERP software

- Jun 14, 2018

- 2 min read

In this topic we will discuss how to do bank charges entry in our account books.

If you will check your ban statement of current account then all GST calculated by them on bank charges. If your current account is in local state/within state then CGST & SGST will apply on bank charges. In this format you will get information of GST applied in bank statement. How to maintain this entry in your account book we will discuss here.

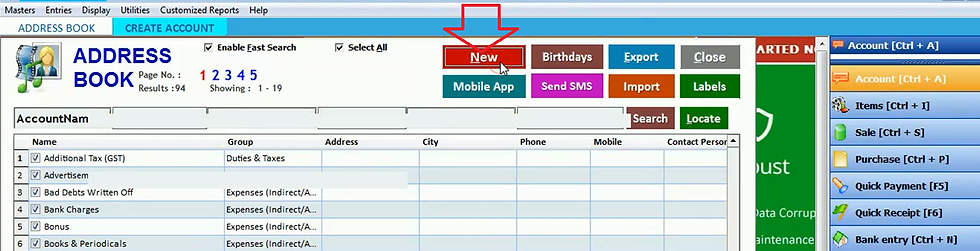

First of all we will create current account in ERP software. Thus click on account in master menu.

Click on new.

Fill bank name in account name. Select bank accounts in group and fill city and state code of bank. As the government launch the GST system, bank has send you it’s GST number. Now select B2B party type and fill GST number of bank. If you do not have GST number then you can call bank to recommend GST number. After filling all details click on save.

Now click on purchase type in master menu.

Click on new.

Now we will create purchase voucher of bank. Fill bank charges in voucher title and select account. Tick tax exclusive and local. Now if you have to claim ITC then select tax invoice otherwise select retail invoice. Then click on save.

Click on GST voucher in entries menu.

Click on new.

As soon as you click on new the date will be automatically selected. Select expense voucher in entry as you are doing bank charges entry. Now select credit in terms. Select party and type. Then press enter. Thus software will automatically fill the voucher number and bill number. Select tax % and fill the bank charges amount in taxable amount. Then press enter. Thus software will automatically calculate the GST and the net amount. Now click on save.

Now we will check our day book by clicking on day book in display menu.

Select date range and click OK.

Thus you can check debit and credit detail. You can see the 354 rupees will be credited from your bank current account.

Now click on profit & loss in display menu.

In this account the bank charges loss & profit will display. These are our indirect expenses which are shown in profit and loss account directly.

Comments