Importance of Account Masters in ERP Software

- Dec 1, 2017

- 5 min read

Updated: Apr 14, 2018

As we know that lot of transactions takes place in a business organization. To recognize the various transactions, the account heads are created. Account head is a name under which particular types of transactions are recorded. For eg. all the transactions related to Cash are recorded under Cash A/c; expenses are recorded under Expenses head.

So, we’ll see how to create Account Heads

Click on Account option in the right side menu or top menu on the above screen.

We see the list of all the created account heads in Address Book.

Click on “New” to create new account.

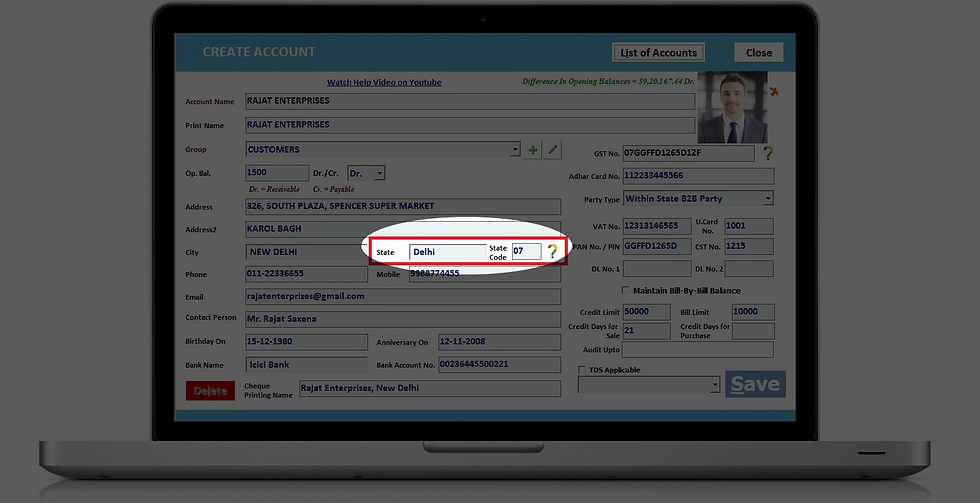

Fillup all the details carefully

Account Name

Here you can enter the popular name of the particular ledger account. e.g. Rajat Enterprises in the Example above is the name of party with whom we deal in business.

In case there are more than one party with same name, then enter something to distinguish between them for example. Rajat Enterprises, New Delhi. Rajat Enterprises, Noida etc.

Print Name

By default, the name entered in the "Account name” data field is displayed as Print Name. Change print name in case you want some change in the name to be Printed.

For Example Account Name = "Rajat Enterprises", In Invoice printout you want to write it as "M/S Rajat Enterprises India Ltd." then you can write this name as Printname, otherwise leave it as it is.

Group

Group help the erp software to decide what kind of account you are creating. This is very important to understand the concept of groups as such all the accounting treatment will be done on the basis of groups being selected at the time of creating account masters.

By looking at Account Group of an account, you can easily identify out which type of account and how it will be treated in erp software i.e. if it is customer then it will be shown in Sale entry

Here's list of various default account groups given by default in erp software.

Bank Accounts

Bank O / D Accounts

Capital Account

Cash-in-Hand

Current Assets

Current Liabilities

Customers

Duties & Taxes

Expenses (Direct / Mfg.)

Expenses (Indirect / Admn.)

Fixed Assets

Income (Direct / Opr.)

Income (Indirect)

Investments

Loans & Advances (Assets)

Loans (Liability)

Pre-operative Expenses

Profit & Loss

Provisions / Expenses Payable

Purchase

Reserves & Surplus

Revenue Accounts

Sale

Secured Loans

Securities & Deposits (Assets)

Stock-in-Hand

Sundry Creditors

Sundry Debtors

Suppliers

Suspense Account

Unsecured Loans

Opening Balance, Dr. / Cr

If there are any amount receivable or payable to the party being created, then enter that amount here as opening balance.

Select whether opening balance is Dr. Balance (Receivable) or Cr. balance (Payable)

Address, Address2, City, Phone, Mobile, Email ID

Input Contact details of party carefully as such it will be printed on all the invoices and statements

State and State Code

Under GST system, its very important to enter party's state and its state code properly. To avoid any mistakes, ERP Software's intelligent intuition system will automatically suggest you state name as you type a few characters and also pickup its proper state code as and when state name is entered accurately.

Here's list of all state codes under GST system for your quick reference

GST No.

All the business entities registering under GST will be provided a unique identification number known as GSTIN or GST Identification Number.

Currently any dealer registered under state VAT law has a unique TIN number assigned to him by state tax authorities. Similarly, service tax registration number is assigned to a service provider by Central Board of Excise and Customs (CBEC).

Character count feature helps you input correct information

Structure of GST Identification Number:

Every taxpayer will be assigned a state-wise PAN-based Goods and Services Taxpayer Identification Number (GSTIN) which will be 15 digit long.

The first two digits of GSTIN will represent the state code. Each state has a unique two digit code like “27” for Maharashtra and “10” for Bihar.

The next ten digits of GSTIN will be the PAN number of the taxpayer.

13th digit indicates the number of registrations an entity has within a state for the same PAN.

It will be an alpha-numeric number (first 1-9 and then A-Z) and will be assigned on the basis of number of registrations a legal entity (having the same PAN) has within one state.

For example, if a legal entity has single or one registration only within a state then it will be assigned the number “1” as 13th digit of the GSTIN. If the same legal entity gets another or second registration for a second business vertical within the same state, then the 13th digit of GSTIN assigned to this entity will become “2”. Similarly, if an entity has 11 registrations in the same state then it will be assigned letter “B” in the 13th place. This way up to 35 business verticals of any legal entity can be registered within a state using this system.

· The fourteenth digit currently has no use and therefore will be “Z” by default.

· The last digit will be a check code which will be used for detection of errors.

Party Type

Party Type lets you define in the account master, what kind of customer or supplier this is. In most of cases ERP Software automatically figures out the perfect party type on the basis of state define while creating a company, customer's state and customer's GST No.

Party type is very intelligent feature of ERP software as such it will help in automatically selecting the sale type and purchase type at the time of sale or purchase entry. Its pretty easy to find out perfect party type, e.g. if customer belongs to same state and have GST Number then choose "Within state B2B Party".

Notice that if you have selected party type carefully then at the time of sale or purchase entries, sale /purchase type is automatically selected

IT PAN

IT PAN means Permanent Account No. provided by Income Tax Department. Popularly its known as PAN No.

Maintain Bill by Bill Balance

This is one of the great features of ERP Software. Bill By Bill Balance lets you adjust received or paid amount against respective bills. in regular business practice, most of the businessmen prefer to adopt maintenance of their ledger balance bill by bill as such it brings transparency in all the transactions and helps in day to day collection.

Bill by Bill is very useful for wholesalers, traders, distributors, agency holders. In these trades, customers are given credit like 15 days credit or 21 days credit. Suppose if invocie is generated on 03-11-2017 and customer is allowed credit for 15 days then payment of this invoice will be due on 18-11-2017. Similarly invocie generated on 5-11-2017 will be due on 20-11-2017.

Proper tracking of payments received against these invoices can be maintained only if your ERP software provides the facility to maintain party's balance bill by bill.

To maintain the account balance bill by bill. Check "Maintain Bill-By-Bill Balance." There may be some payments remaining at the time of creating ledger account master. To Input these bills Click on the "+" sign next to Maintain Bill By Bill Balance Check.

By clicking on the + Sign, erp will prompt you to input bills whose balances are remaining at the time of creating ledger account.

Notice that in Quick Receipt, it will ask you to select againt which bills, amount is to be adjusted. If you want a list of payments to be collected against various bills and when these will be due, calclate interest in case late payments then see Display >> "Bill Wise Collection Register"

Credit Limit, Credit Days

Lets you deefine business terms being set with particular customers or suppliers

📷

hi its very comfertable software & best for all catagary.

kindly just add godown option for inventary managment its very needful