Special cess entry in ERP Software

- May 15, 2018

- 3 min read

Updated: May 19, 2018

Today we will discuss how to do additional GST/special cess entry in GST system.

Two type of additional GST can be applied on some items

1.Cess

2. Special cess

On some items such as cigarette, tobacco, pan masala, soft drinks, luxury cars special cess is applicable. You can configure it easily in latest version of ERP software.

Special cess can applicable on taxable amount. It can also applicable on quantity of items. For eg. On big size filtered cigarette 5% GST and 2.126 rs per cigarette as special Cess is charged.

You can billing of the items with special cess and without cess in a same bill.

Now we will discuss how to do setting of special cess.

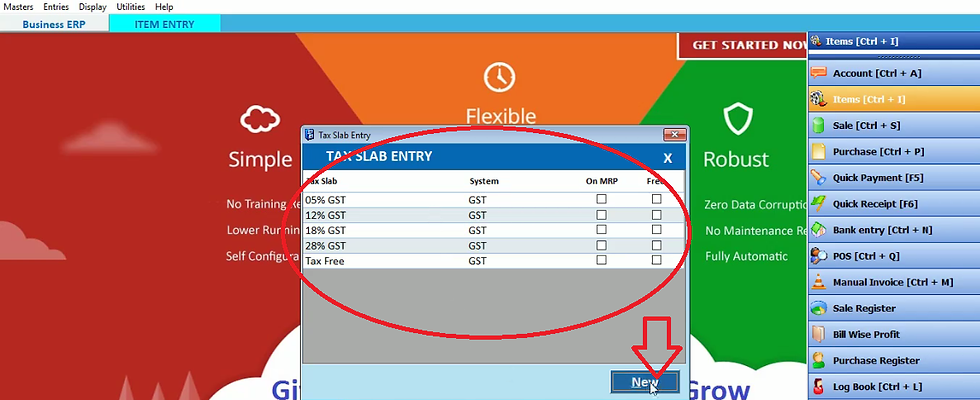

First of all we create tax slab for special cess.

Click on tax slab in master menu.

Here you will see the already created slab. To create a new slab click on new.

Fill tax slab name, category, SGST and CGST. IGST will be automatically counted.

Now fill the special cess. If you are applying special cess on quantity then suppose you are filling the special cess for cigarette and in as per select alt. qty. as it is applied on quantity. Click on save.

Thus this slab will be added in GST slab list. Now we will create another GST slab. Click on new.

Fill tax slab name, SGST, CGST. IGST will be automatically calculated.

On some items the special cess is applicable according to percentage. Suppose we will fill here 204 in special cess it means we will apply cess according to 204 %. Now select taxable amount in as per bar as this tax applied in %. Now click on save.

This slab will also add in the slab list. Thus you can create tax slab very easily. Now close it.

Now we will create item on which special cess will apply.

Now click on items on right hand side.

Click on new.

Fill item name and short name. Now in tax slab select the slab which is applicable on that particular item with special cess. Now select primary unit. Now click on the sign as indicated above.

Now select alternative unit and fill the conversion factor box,. Suppose you have filled the alt. unit as pieces then in one box cigarette pieces is 10 then we select 10 in conversion factor. Now if you want to sell that item per box then select box in price per bar. Fill selling price and click on save.

In the same way we will create one more item.

Click on new.

Fill the item name and all details. Fill the sale price and click on save. Now close it.

After doing item entry we will do sale entry.

Click on sales on right hand side.

To do new sale entry click on new.

Here date will be automatically selected. Select terms and select the customer name from party list. Select sale type. Now select the item that you want to sell. Fill the quantity of item. Now you will see the tax amount will be automatically selected and the net amount will be counted. Now press enter.

Thus this item will add in the sale.

Now we will do one more item sale entry. Fill item name and all detail. Here you will see the tax amount will be automatically counted as we mentioned while doing item entry. After addition of basic amount with tax amount the net amount will be automatically calculated. Now press enter.

Now we will do another item sale entry. After filling all details press enter. Thus these three item sale will be added in the sale entry list. Now click on save.

If you want to see print preview of bill then click on yes otherwise click on NO. Now close it.

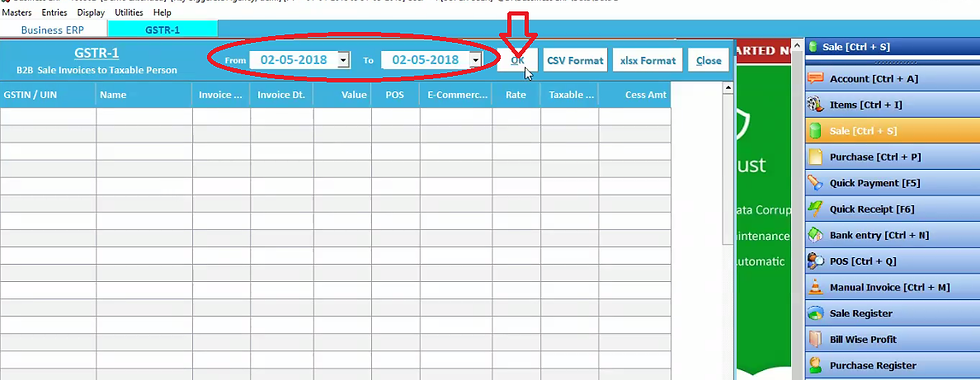

Now we will check sale entry effect on reports. To check report click on GSTR1 in GST reports in display menu.

As we have GST number and our customer also have GST number therefore it was B2B sale.

Therefore we will check B2B taxable invoices by clicking on B2B taxable invoices.

Click OK.

Thus here detail of all item sale will display. In rate we can see the GST applied on items and the special cess block display the special cess applied on these items. Now close it. Thus in this way you can check the detail of tax applied on items

Comments